Childcare UK Market Report 16ed (with Covid-19 updates)

What the report includes

- * NEW * Coronavirus chapter

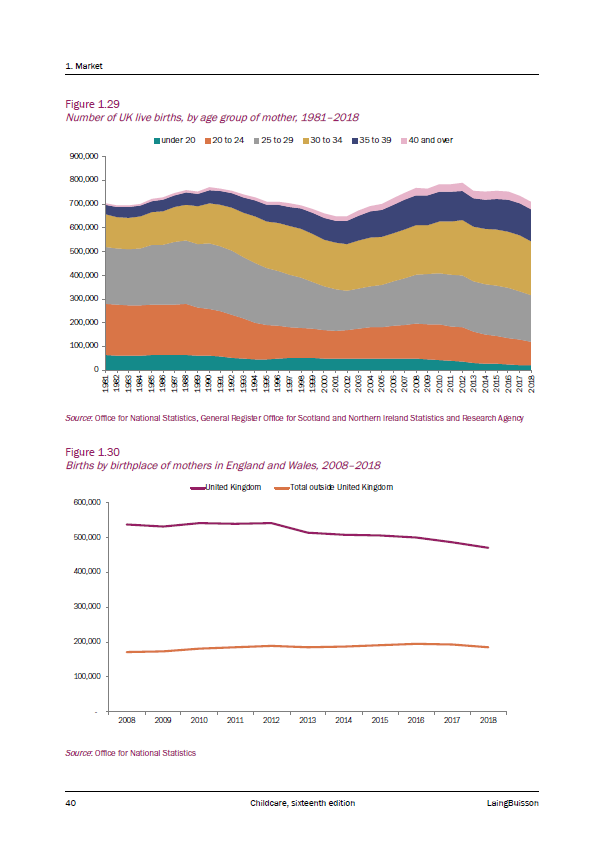

- Market

- Politics and Regulation

- Payors

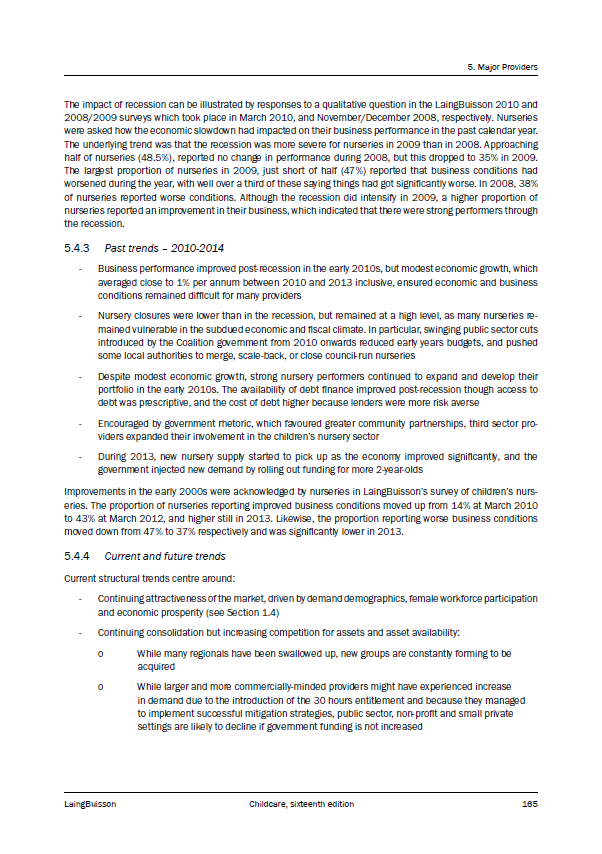

- Major Providers

- Investors

- Staffing

- Market Potential

- Appendices

Glossary

Key Legislation Appendix

Regulators Appendix

Trade bodies Appendix

Commissioning bodies Appendix

Financial Appendix

Who is the report for

- Independent nursery providers

- Local authority providers

- Policy makers

- Banks

- Private equity investors

- Lawyers

- Management consultants

What You Get

- Print package – Single-user Printed Book

- Digital package – Multi-user Digital PDF and Data in Excel + Printed Hard Copy

Want to know more? Our sales team can help.

Call: 020 7841 0045

Email: [email protected]

LaingBuisson’s comprehensive study into the UK’s childcare market. Sixteenth edition. Published orginally on 23 March 2020 (282pp) and updated 8 February 2021 for Covid-19.

The full updated sixteenth edition of LaingBuisson’s Childcare UK Market Report, is essential reading for anyone involved in this historically fast-growing sector. Written by leading education management consultancy, Cairneagle Associates, the updated 2021 reprint charts what has happened in the childcare sector from the early days of the pandemic, through to the third lockdown. The insights provided by this chapter, added to the wider report, make this vital reading for any investor, advisor or provider to this dynamic market.

Strong historic growth and a socially responsible profile continue this market attractive for investors looking for safe havens for their money. With the market still being highly fragmented, there are still benefits to be gained from consolidation.

It also holds the possibility of accretive earnings per share since nurseries are usually worth more in a group than as discreet entities, and there is the chance of outperforming the market by making better commercial decisions. In addition, there is strong support for investment in this market from debt providers.

The updated report also places a focus on the market’s potential in the wake of the pandemic. Questions arise over birth rates, how easy or not it will be to recruit staff, and how changes to the planning use class system may influence the future of childcare. Nevertheless, as the authors conclude, nurseries are a sector that have manoeuvred the crisis better than other parts of the economy.

“We believe that the childcare market will remain attractive to investors. Many are attracted because childcare is viewed as a socially responsible market to be in, but opportunities equally lie in earnings per share being accretive (namely, a nursery is worth more as part of a group) and there is strong support from debt providers. There are also opportunities for growth by outperforming the market by making better commercial decisions and the potential for internationalisation. There is also the opportunity to scale by means of new developments and by ‘organic’ growth and diversification.

“There are, none the less, lessons to be learned from what has happened in the past two decades. Growth is not a given for investors and there is certainly a danger in growing too quickly. Some have failed by not understanding how to operate at scale and also not realising the potential impact of changes in the regulatory environment.”

Arun Kanwar, report author

In partnership with

£895.00 – £2,995.00