Investing in Healthcare and Real Estate Market Report 2ed

What the report includes

- Healthcare focused private equity firms

- Selected private equity investors

- Health and care indices

- HMUK Index

- CMUK Index

- HMi Index

- CareMonitor Hospitals

- Major acute hospitals

- Major mental health hospitals

- Major adult specialist care

- Major adult care

- Major adult care, third sector

- CareMonitor Adult Care

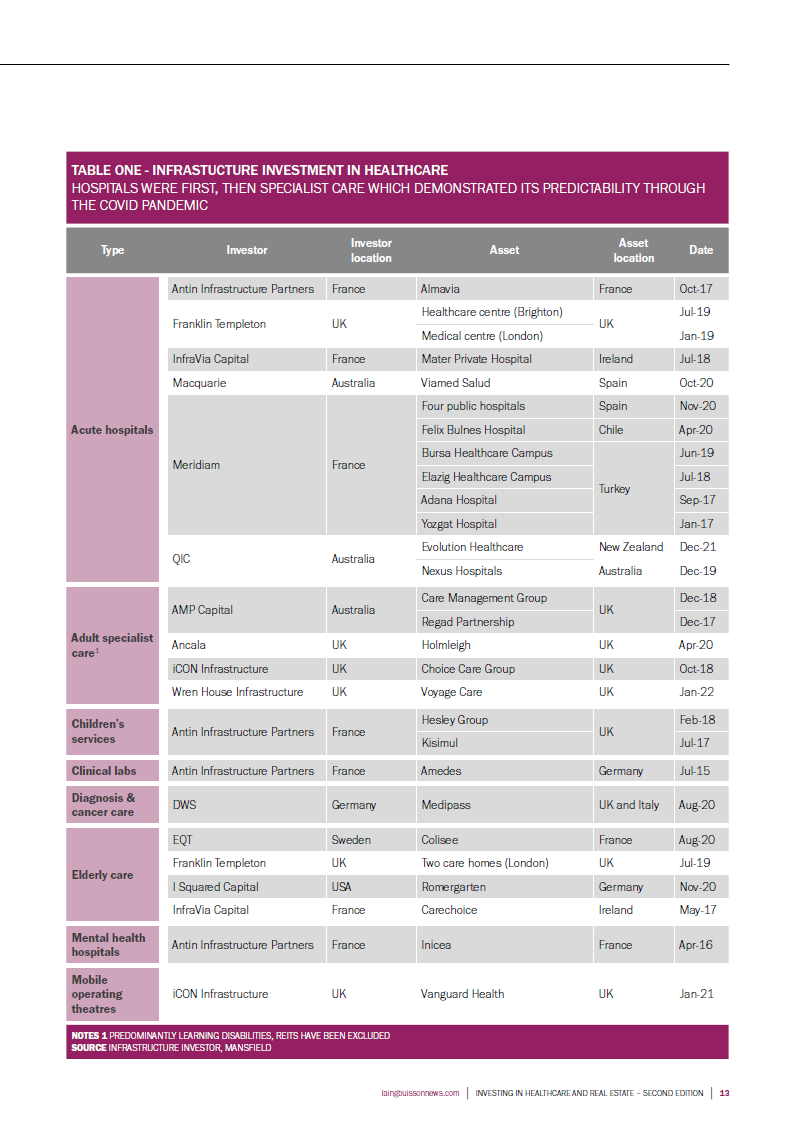

- UK private equity deals

- Major international hospitals

- Selected international deals

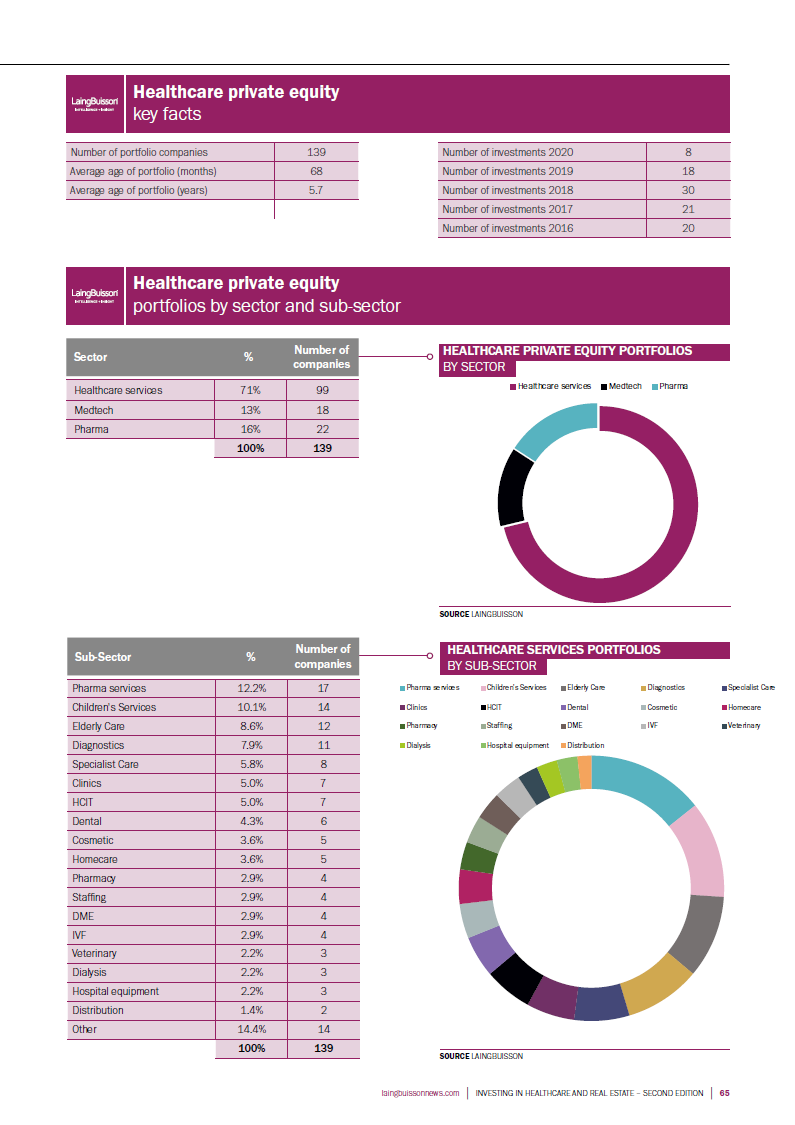

- Healthcare private equity portfolios & key facts

- Healthcare real estate listings, valuers and agents

- Healthcare real estate deals

- Healthcare REIT Index

- Healthcare real estate

Who is the report for

- All C-suite professionals working in UK healthcare

- All C-suite professionals working in UK construction and planning

- Banks and financial institutions

- Investors and private equity

- Health insurers

- Government policymakers

- Lawyers

- Policy advisors

- Think tanks

- Management consultants

What You Get

- Digital package – Multi-user Digital PDF

Want to know more? Our sales team can help.

Call: 020 7841 0045

Email: [email protected]

Digital report only. This is the second edition of the Investing in Healthcare and Real Estate Report, LaingBuisson’s annual report into the role of real estate and healthcare REITS in UK healthcare market. Published 30 March 2022. (118pp). NB Digital Files Only.

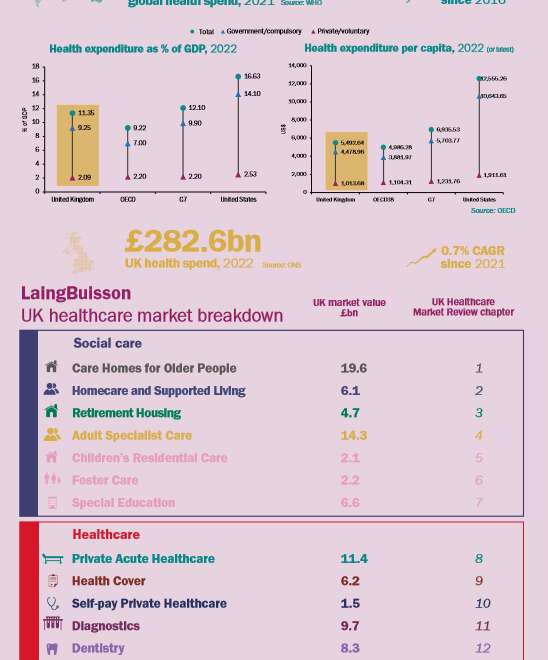

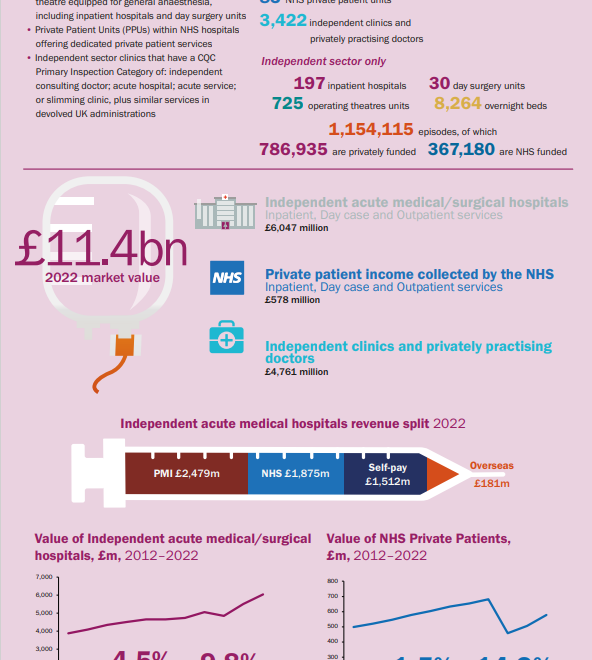

LaingBuisson’s Investing in Healthcare and Real Estate is a further reminder of the interconnectedness of the modern world. Healthcare accounts for 10% or more of economies across the developed world, and social care adds another 2-3 percentage points. The USA is by far the largest market.

While the share of healthcare delivered by the private sector varies widely from country to country, even those with relatively ‘socialised’ healthcare systems have a place for independent providers and health and social care. And this is big business, whether in the delivery of frontline services, healthcare products or the digital platforms that promise to make healthcare more efficient and, in many cases, empower customers.

As we emerge from Covid, and as the world’s economies face broader challenges in terms of commodity price increases and other repercussions resulting from the Russia/Ukraine conflict, healthcare continues to offer a relatively safe haven for investors owing to the strength and relative stability of demand for healthcare services. The response of all governments, almost without exception, is to maintain spending on healthcare during economic shocks, as part of the unwritten social contract that maintains cohesion and stability. This has been bourn out by the UK government’s Covid response, where spending on the NHS was increased substantially despite the pandemic’s massive hit to GDP. When the figures become available, we expect to find spending on healthcare services has been highly resilient across the OECD.

Although there was a dip in UK healthcare transaction involving healthcare private equity in 2020/21, health and social care remains a massive market with no shortage of opportunities for healthcare-focused private equity firms and property investors. This year’s edition contains a wealth of information and commentary which bears witness to the enduring strength of the healthcare sector and the investment opportunities it offers.

Discounts available for delegates attending the Investing and Healthcare & Real Estate Conference 2022 and for LaingBuisson Members.

Please contact our sales team to obtain your coupon code.

£175.00