Private Acute Healthcare Central London Report 9ed

What the report includes

- Market Overview

- Sources of Funding

- Independent Providers

- NHS Private Patient Units

- Outer London

- Appendices

- Glossary

- Regulators

- Trade associations

- Provider profiles

- Financial appendix

Who is the report for

- Hospital & Clinic C-Suite Professionals

- Specialist Acute Medical Care Providers

- Private Medical Insurance Groups

- Clinical Commissioning Groups

- NHS Foundation Trusts

- Investors

- Banks

- Private Equity

- Architects

- Property Developers & Consultants

- Central & Local Government

- Think Tanks

- Lawyers

- Management Consultants

What You Get

- Print package – single-user Printed Hard Copy

- Digital package – Multi-user Digital PDF and Data in Excel + Printed Hard Copy

Want to know more? Our sales team can help.

Call: 020 7841 0045

Email: [email protected]

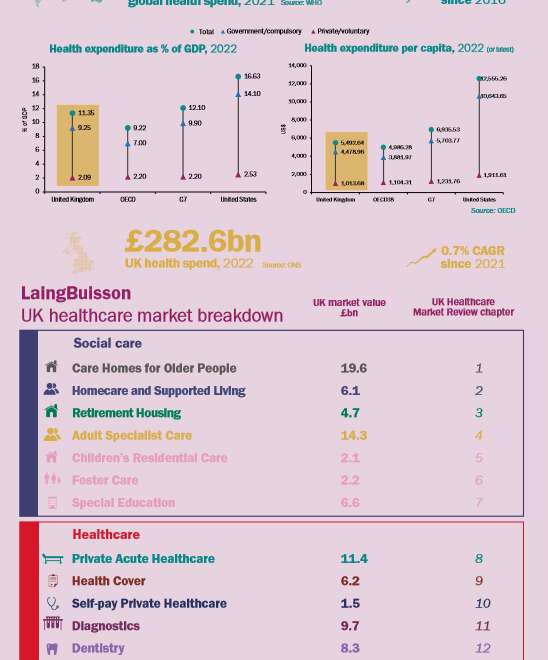

How are independent hospitals in London faring post-Covid?

LaingBuisson’s comprehensive study into the UK’s private healthcare market in Central London. Ninth edition.

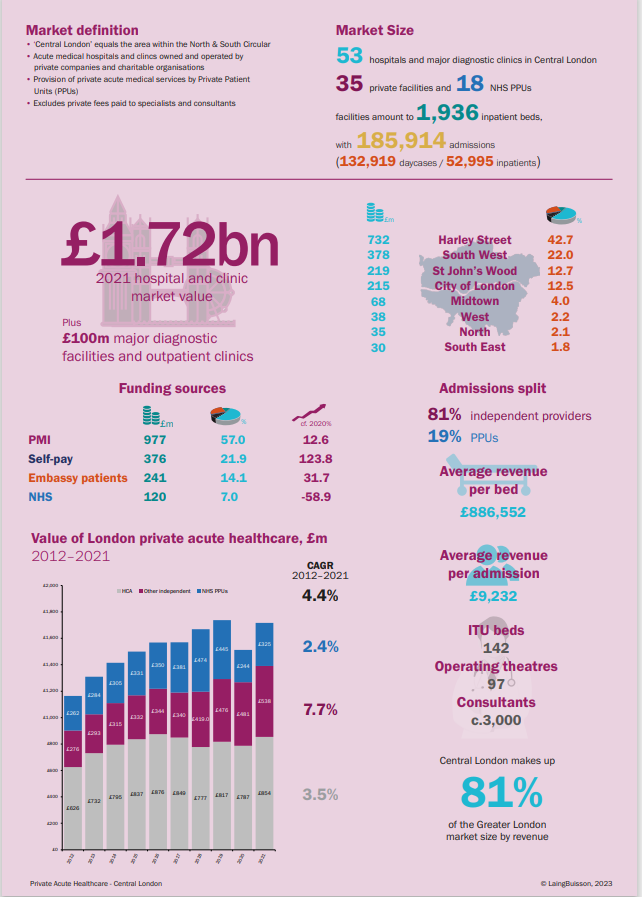

Despite the challenges posed by the pandemic, the Private Acute Healthcare Central London Market Report, Sponsored by Reputation, presents a market that has bounced back to pre-pandemic levels. This is thanks in part to an increase in self-pay patients. With strong underlying growth predicted for 2022 and beyond, the report raises the question of whether the independent sector is ready to rise to the challenge or will rising costs hinder future growth?

With fierce competition among providers, including new entrants such as Cleveland Clinic London, the report offers valuable insights combined with extensive data analysis into the future of the sector. Findings of the report include:

- Analysis of the private acute healthcare Central London market after the peak of the Covid-19 pandemic and how the market has returned to pre-pandemic levels.

- The increase in the number of self-pay patients, in part due to increased NHS waiting lists.

- Impact of the Covid pandemic on NHS Private Patient Units (PPUs) and their slower recovery compared to the rest of the independent sector.

- Highly competitive nature of the market as overall inpatient bed capacity increased by over 10%

- The report raises the question of whether the independent sector is ready to shine or will pressures of rising costs hinder future growth?

Comments from report author

“‘While revenue growth has returned to the market, after a long period of drift even pre-Covid, the big issue continues to be a fight for market share, with increasing costs of employing or sharing revenue with consultants, not to mention staffing constraints, wage pressures and cost inflation, continuing to impact on the bottom line. And all of this is occurring at a time when profit margins have already been under pressure for some time. It may be that there will be some consolidation in the not-too-distant future.

“PPU growth is not guaranteed, with some hospitals vulnerable to the loss of a few consultants or the transfer of specialities to other hospitals, as well as limited capacity (e.g., access to ITU beds or theatres) or organisational cultures that are against doing private work. At least some PPU hospitals are starting to operate more commercially outside their hospital facility.”

Published: 10th May 2023 (434pp)

Supported by

£1,495.00 – £3,695.00