Sorry, this product cannot be purchased.

Retirement Housing UK Market Report 2ed

What the report covers

- Market size

- Market growth

- Demand drivers

- Business models

- Staff supply

- Politics and regulation

- Payors

- Major providers

- Investors

- Market potential

Who is the report for

- Operators of retirement housing schemes

- Property developers

- Providers of age-exclusive ‘downsizer’ housing

- Retirement living providers

- Housing with care providers

- Housing associations

- Staffing agency operators

- Directors of adult social services

- Care advisors

- Banks and investors

- Management consultants

- Business advisors

- Long-term care insurance providers

- Central government

- Think tanks

- Policy writers

What You Get

- Print package – Single-user Printed Hard Copy

- Digital package – Multi-user Digital PDF and Microsoft Excel files + Printed Hard Copy

Want to know more? Our sales team can help.

Call: 020 7841 0045

Email: [email protected]

What makes UK Retirement Housing so investible?

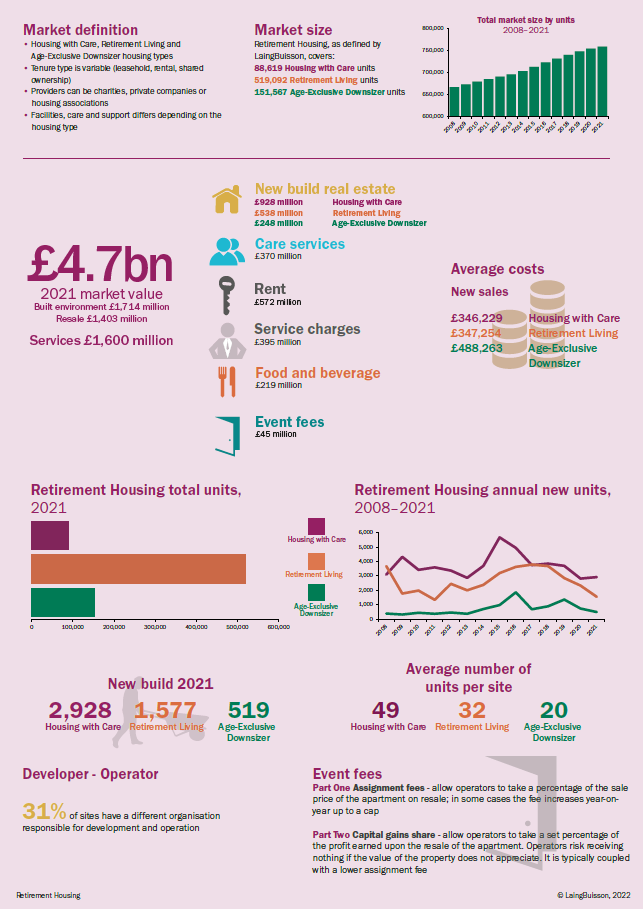

The second edition of LaingBuisson’s highly anticipated Retirement Housing UK Market Report offers a complete overview of care and accommodation options for older people in the UK. The segments covered include age-exclusive ‘downsizer’ housing, retirement living and housing with care.

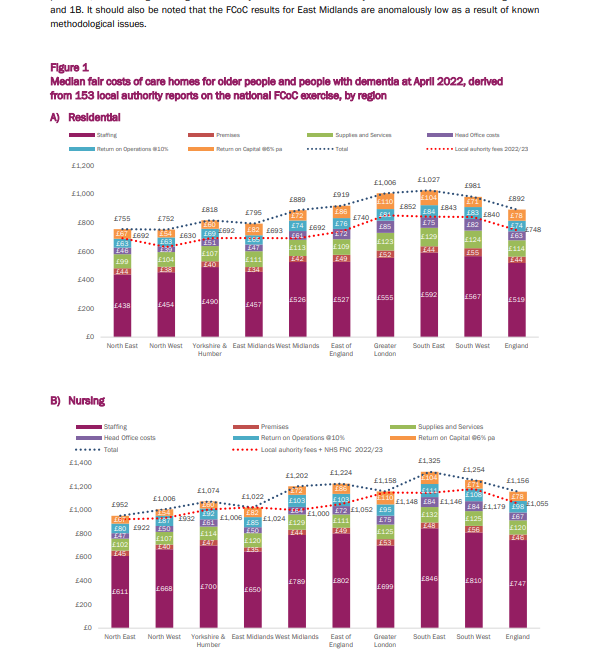

Read together with Care Homes for Older People UK Market Report 32nd edition, published in March 2022. Together, they offer a complete overview of the UK’s accommodation and care options open to older people.

The retirement housing market has, anecdotally, experienced a strong rebound following the slump of the pandemic. It is highly attractive for investors looking for long-term yields. This is because several segments of the market look set to expand, because stakeholders are looking to alternative models for those with less acute needs. Furthermore, there are opportunities at both at the exclusive and more mass market ends of the market. For example, town centre developments are becoming more of a possibility as retailers leave the high street.

Retirement housing for over 55s

Discussions surrounding accommodation for the over 55s are ever-growing in the UK. This is due to an image problem for the market, which is causing it to suffer. Nevertheless, the market has the potential to offer investors secure long-term yields. This is a topic that is explored extensively in the report.

ESG

Another challenge facing the retirement housing market is the rise of the ESG agenda. While retirement housing enjoys good ESG credentials, investment is also needed to update older stock to meet net-zero.

Comments from the report author

“The retirement housing sector needs to face up to what needs to change for the market to reach its potential. The people retirement housing providers are seeking to engage have great diversity of experience, attitude, health and wealth. This needs to be reflected in more choice, not less. People need to be persuaded of the advantages of having access to care and services when they need them, even if they are not an immediate requirement.

“Imagine a country where diversity of choice and inspiring housing encourages people to choose to move early in retirement. They could move into a purpose-built, technology-enabled accommodation, and in doing so, free up under-occupied family housing. This in turn will improve their independence and provide care and other services when needed. Occupiers are less likely to need NHS services and can return sooner if they do, saving money and freeing up beds, and their social care needs will be met by staff they already know and trust. They will lead active and fulfilling lives in a community and will maybe still be close to where they lived most of their lives before the move.”

Published 24 May 2022. (436pp).

Sponsored by

£1,360.00 – £3,410.00