Temporary Recruitment and Staffing: Healthcare 1ed

What the report covers

- Overall market value, and values for key segments

- Projected growth estimates and key factors affecting short, medium, and long-term outlook

- Agency staff and bank staff spend over time

- Independent hospitals and GP locums

- Supply and demand factors

- NHS Long Term Workforce Plan

- Agency Rules Framework and price-cap requirements

- Key issues facing recruitment agencies

- Investor profiles and key investment activity

- Major transactions

- Appendices

- Glossary

- Regulators

- Trade bodies

- Major agency profiles

- Financial appendix

Who does the report deliver value to?

- NHS C-suite professionals and workforce leads

- Integrated Care System workforce leads

- Central government

- Recruitment agencies and other staffing solution providers

- Investors

- Banks

- Private equity

- Management consultants

- Think tanks

- Lawyers

Want to know more? Our sales team can help.

Call: 020 7841 0045

Email: [email protected]

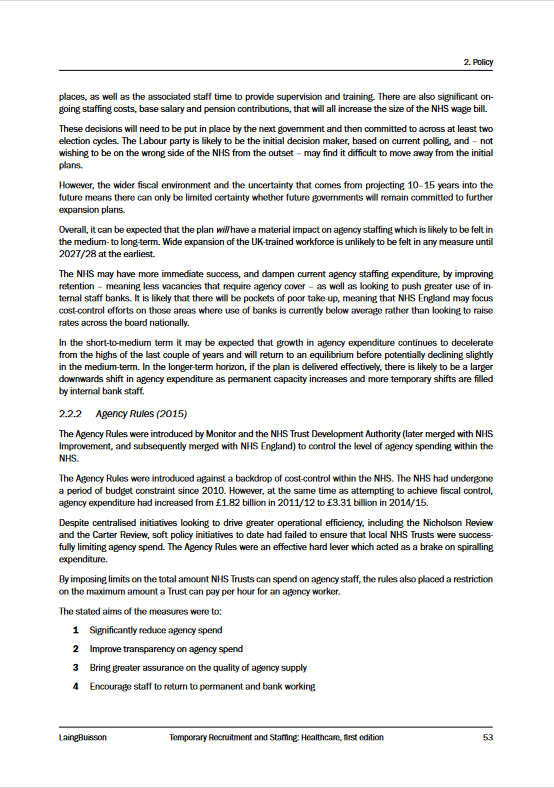

Market value for temporary healthcare agency staff above £5.1 billion as the NHS struggles with workforce cost-control after the pandemic

The first edition of LaingBuisson’s Temporary Recruitment and Staffing: Healthcare – UK market landscape report is vital reading for anyone involved in this highly competitive sector of the UK health economy, be they investors, lenders, those offering staffing solutions or strategic leads for workforce planning in healthcare providers.

Our market landscape report (published in December 2023) takes stock of the recruitment agency market for temporary healthcare staff against a backdrop of rapidly rising expenditure on non-permanent staffing solutions, following several years of relatively tight fiscal control. The report provides a data-driven view of the challenges facing those looking to contain spend and deal with chronic workforce shortages, and looks ahead to the opportunities and challenges facing the sector.

The report provides a robust credibility check on key questions for those interested in investing in the sector, understanding the opportunities for new solutions or making strategic decisions on workforce planning.

Deep insights into the market value, with analysis on historic spend and changes in the make-up of the workforce, along with a thorough understanding of how key strategy and policy drivers, such as the NHS Long Term Workforce Plan, the Agency Rules Framework, inform our market outlook and the view over short, medium and long-term horizons.

Among opportunities and threats to the sector, the report considers the rise of insourcing agencies, the relationship between spend on agency and bank staff, and major movements by existing corporate operators and private equity interest.

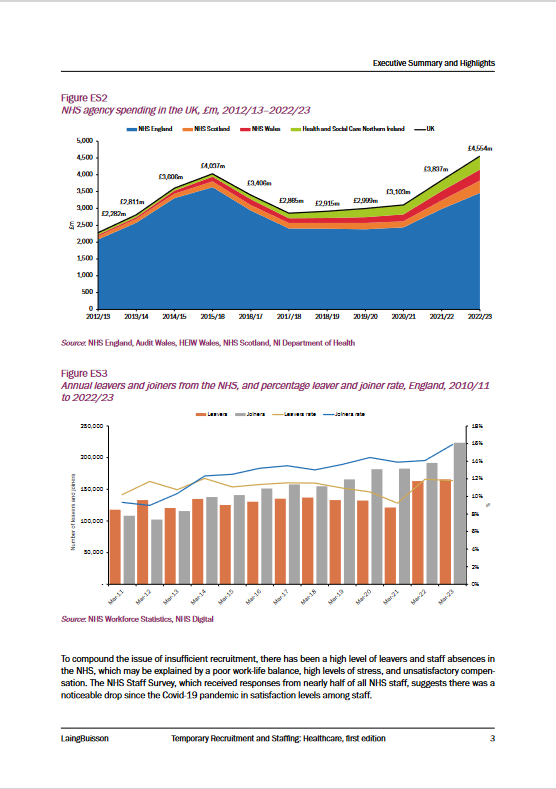

In total, the temporary healthcare recruitment agency market is valued at £5.1 billion across the healthcare sector, with a 11.8% CAGR over the last five years. This sits alongside a further £5.8 billion spent by NHS England on bank staff. The NHS Long-Term Workforce Plan provides some hope for managing future pressures, but provides little short-term options, with spend projected to continue to grow in the short-term.

Transactions since 2020 remain above historic levels and suggest a buoyant market that retains investor interest, and a high level of fragmentation suggest potential acquisitions remain in the sector for those looking to grow at scale. As such, this important report provides a crucial update on the current position of the market and its key emerging trends.

Downloads

![]()

What You Get

- A multi-user digital PDF report

- Supporting Market Report Data Workbook in Microsoft Excel format

£995.00